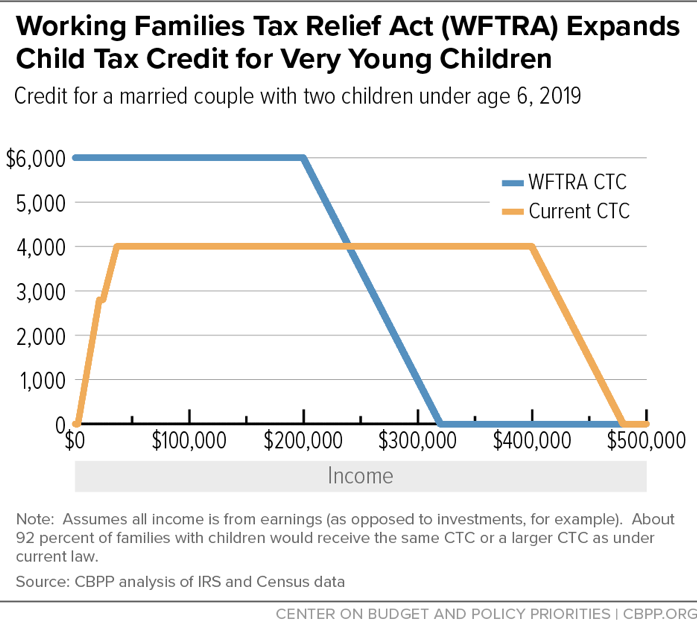

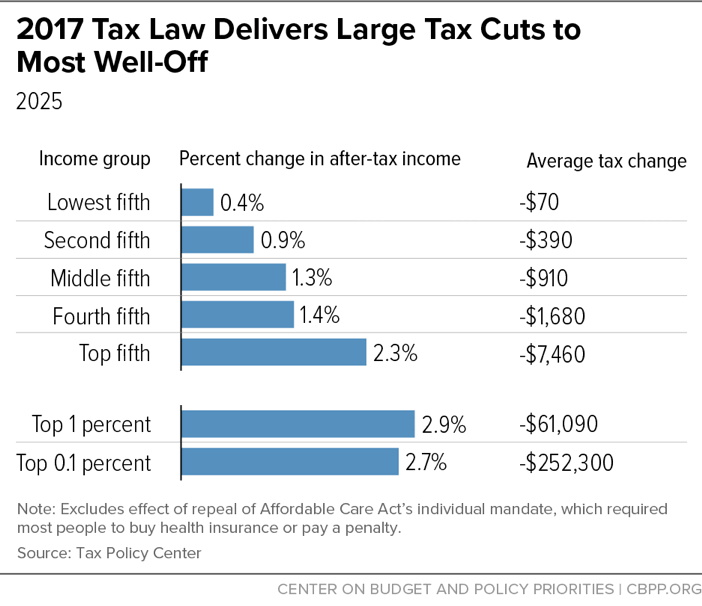

Working Families Tax Relief Act Would Raise Incomes of 46 Million Households, Reduce Child Poverty | Center on Budget and Policy Priorities

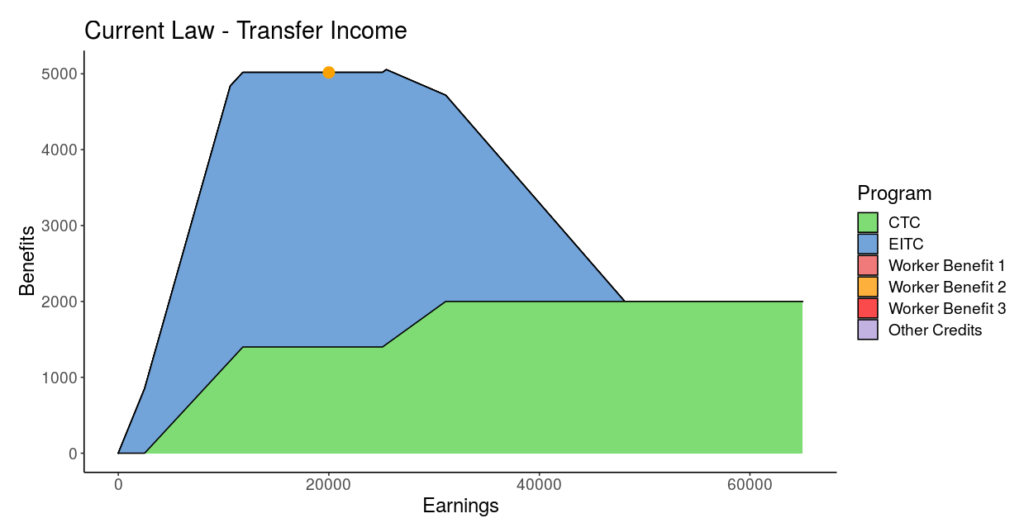

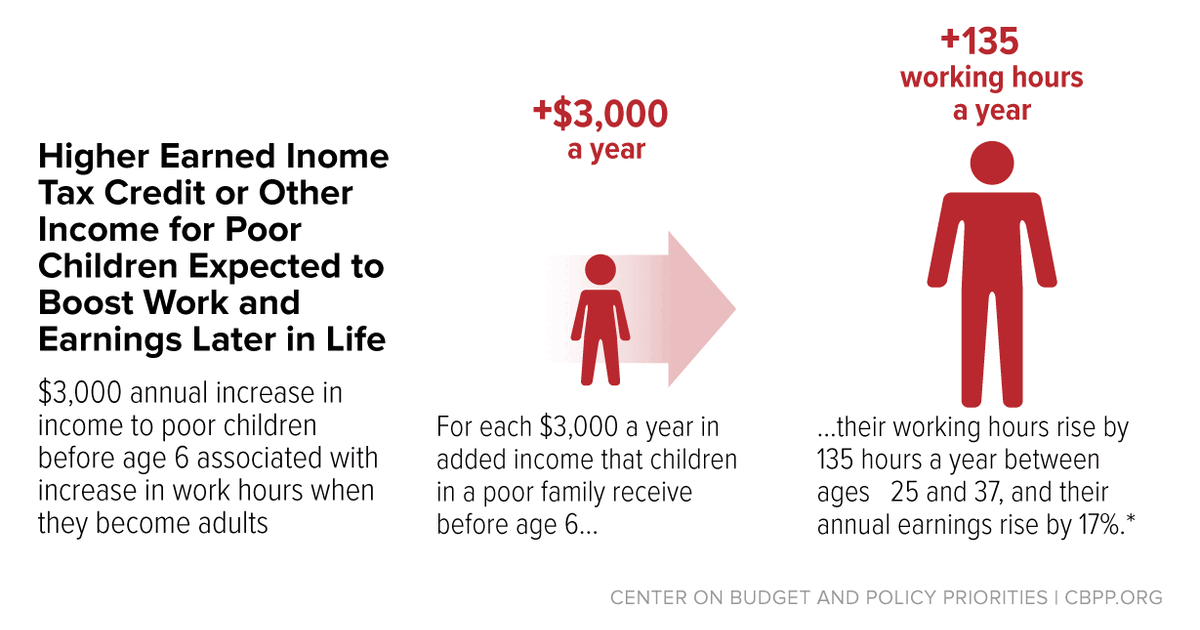

EITC and Child Tax Credit Promote Work, Reduce Poverty, and Support Children's Development, Research Finds | Center on Budget and Policy Priorities

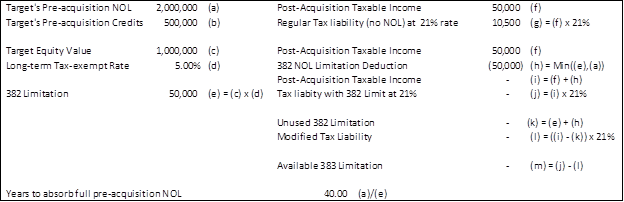

The Optimized CLAT: A Compelling Income Tax Deduction Vehicle Hiding In Plain Sight - JONES & KELLER

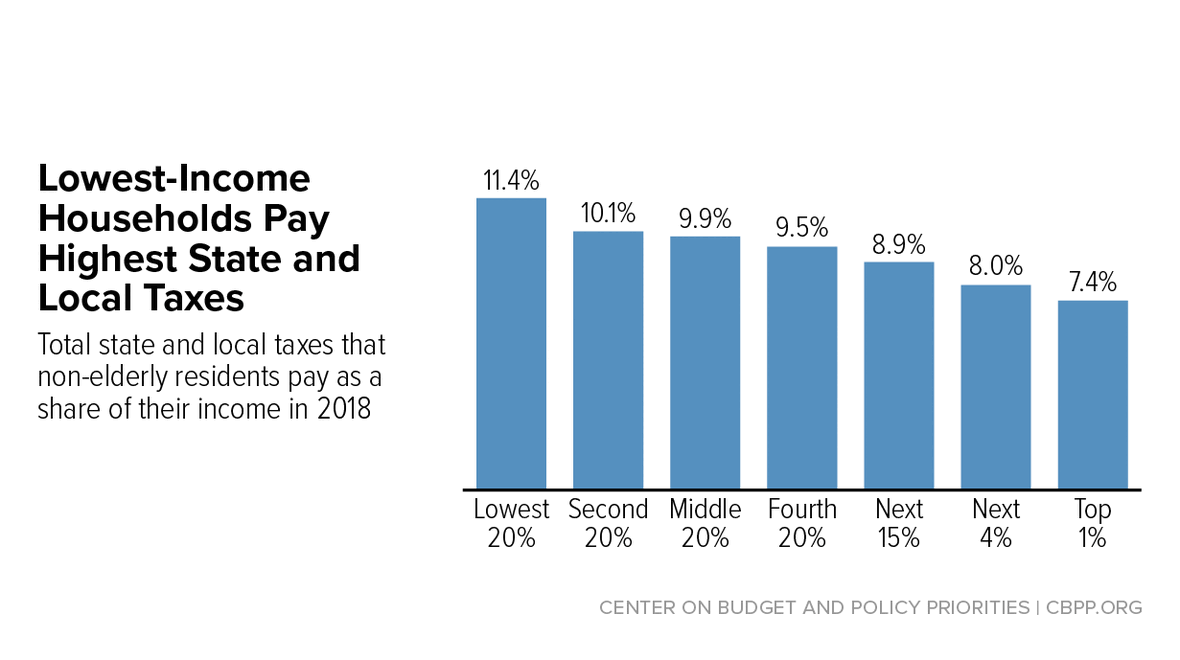

Accounting for What Families Pay in Taxes and What They Receive in Government Spending | Tax Foundation

For the Record : Newsletter from Andersen : Q3 2019 Newsletter : Sweetening the Deal: The Value of Research Tax Credits in a Merger or Acquisition

Research examines the receipt of earned income tax credits among welfare recipients | Federal Reserve Bank of Minneapolis

Do State Earned Income Tax Credits Increase Participation in the Federal EITC? - David Neumark, Katherine E. Williams, 2020